One of the most common problems faced when running research projects is getting hold of people (ahem, the right people) to participate.

And without people (referred to here throughout as ‘participants’) your research isn’t going to go all that well! So, this post looks at ways you can find research participants.

Read time: 3 minutes

tl;dr: The way forward will depend on (i) if you need people who are in or out of your audience and (ii) whether you have a budget (or not).

Who you need to participate in your research 100% depends on your objectives – ie what is it that you want to find out?

This boils down to whether you need participants who are ‘in’ or ‘out’ of your network – whether they are figuratively near you or futher away from you (explained more fully below as ‘proximity’).

The other factor which will determine how you go about finding participants is budget (or lack of).

Proximity

For much of the research a startup needs – like customer discovery or testing an MVP – you can use people who are close to you e.g. they are part of your network, they are on your waiting list or within your following. Let’s think of this collectively as your ‘audience’. It is likely that many of your audience members fit very well with your ideal customer profile (ICP).

Depending on the size of your audience, they should be easier to reach and more willing to help.

But your audience can’t always help you. It will depend on what you’re trying to find out.

Eg. if you want to calculate your market size, it’s very unlikely your audience will work because you’re more likely to need a bigger, more representative sample.

A nationally representative sample will match the UK census in terms of age, location, gender, ethnicity – and any other variables that are important for you.

Eg. you might also need to include a group of people who favour your competitors’ products over your own. This might be so you can find out what they like about your competitors and how you might be able to entice them away. Again this is potentially a difficult group of participants to find within your own audience.

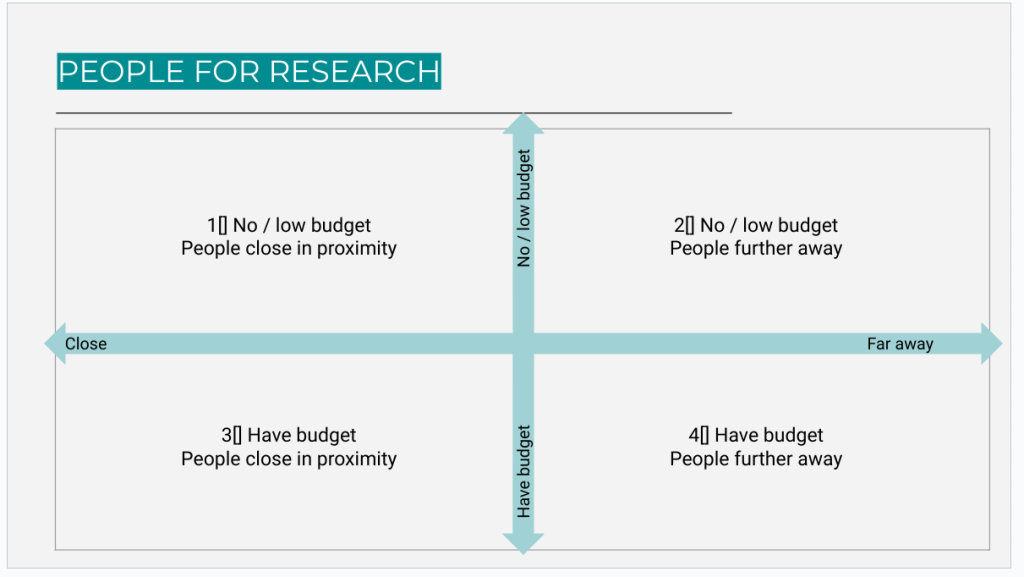

So, looking at proximity and budget, this breaks down into 4 routes to find participants.

Time for a 2×2…

Let’s look at each in more detail…

1 No / low budget, need people who are close

If you have a large ready-made audience this will be relatively easy. If you don’t, perhaps you should be building one?

An audience will be a vital asset to grow your business, so get building one and make participation in research another reason for people to sign up.

What about offering them an incentive?

In the market research world, under the Market Research Society’s code of conduct, it is currently not acceptable to exchange goods/services for people’s time to take part in research. I get this – Ben & Jerry’s probably shouldn’t be giving ice-cream to people in exchange for taking part in a focus group.

In the startup world it’s different, you may want to incentivise people by giving them discount codes, free product trials, merchandise etc. to keep budget under control.

An incentive of some kind is not only the right thing to do, but it will also encourage a better level of response, help improve the quality of your sample and improve your data quality.

No cost incentives include:

- Some of your own time in exchange for their

- A copy of the results (if useful to them)

- Emphasising that special fuzzy feeling of reward from taking part in research that will help build an amazing product that will solve a problem the world needs to be solved! (get your copywriter on it!)

2 No / low budget, need people who are further away

This is the toughest route you’ll take and with zero budget it’s going to be very hard to do. You could partner with someone who has the audience you’re looking for. Investigate partners such as:

- Trade bodies

- Membership organisations

- Friendly creators / influencers

- Startup accelerators

- Commercial partners

Think about what you can offer them in exchange for access to their audience.

Even with a small budget, you can find participants more easily e.g. survey participation is highly commoditised these days and you can spend as little as £1 to £2 per person. But if you’re doing a survey of 500, you’ll still need to budget around £1k for data collection.

3 Have budget, need people who are close &

4 Have budget, need people who are further away

Let’s tackle the having budget options together as having money to throw at a problem makes it easier to solve.

If you have your own audience, reach out to them with an incentive of cash – cash works best for most audiences (be careful of the participants’ tax implications if you’re B2B).

Here are some ways you can find people for research if you have budget:

- For qualitative research (interviews, focus groups), outsource to a research recruitment agency. This is what I do and I can recommend some excellent suppliers if you are interested. Expect to pay around £100 per person for recruitment + incentive for a 45-min depth interview

- For quantitative (surveys), use a research panel provider. There are 100s and I can point you to some I use and trust

- Digital ads – very useful way of targeting when you have a really niche group you need to find or if you’re looking for a B2B audience

- Tap into the places your audience is likely to be – the list is probably quite endless and very much depends on who you need to take part

I’d love to know any questions you have so please reply back to me with your thoughts.

Thanks for reading